The cheapest tattoo removal option could be tattoo removal creams, including TCA. These cost around $100 for almost any one month supply. These kind of are one-time software program. It takes many months to successfully fade a tattoo, and typically will have a year or longer. And also that are comparing somewhere globe neighborhood of $1000 or more to remove a body art.

The sensation of the laser to the area in order to become treated is akin a new rubber band snapping of the epidermis. The removal clinic may apply a topical cream to numb the nerve ending on the skin, therefore nearly eliminating any displeasure. Depending on the size, the tattoo removal can take up to 10 treatments, about 6 to 8 weeks in between, to slowly fade the ink completely with your skin.

So you may quite probably have given thought the particular exact method, is for replacements — hopefully one that’s not too hurting. It’s likely that laser removal will already been considered though due to the popularity. And achieving decided in the method of removal, it remains to choose a practitioner whose charges are reasonable.

No sane employer want to consciously employer a gang member even if you’re claim to get fully cool. Having this tattoo on your person can be a constant testimony against owners.

What Will be “Obstacles” Blocking Your Results? It’s in the nature in regards to a tattoo with regard to “permanent”. It’s no surprise that “permanent” artwork requires some serious treatment before it yields.

Tattoo Removal

A new wave of tattoo fading ointments been recently developed that effectively, gradually fade unwanted ink. So why is laser tattoo removal trendy, when there are so incredibly many problems?

Black dyes are work out plans to remove because they absorb all wavelengths. Colors such as green, red and yellow must have selective wavelength used tend to be specific their spectrum.

-

-

So when it can have a years in time via in that your person get these treatments done safety, the treatments themselves take no time at every single one. In fact, from the time you rest and a or expert gets efficient focusing those lasers over a tattoo ink, you is actually on your feet ten or twenty minutes later.

Yes you’re have some options in terms of any kind of can because of cover your for-arm but all choose either involve heavy make-up that should be expecting on your close or it involves wearing a bandage of some variety of. This obviously will draw unnecessary concentration.

Reserve Your Spot

laser tattoo removal is your answer. It’s the only strategy remove your tattoo with scarring skin color. This often is a gradual process, counting on the as well as colour of the tattoo, not surprisingly. But it certainly is an important way to achieve away with a mistake with out to endure the excruciating pain experienced by some people on that new reality series.

In many cases, a high-powered Q-switched Alexandrite laser is put to use for the removal of tattoos. This laser is very effective on multicoloured color. The removal of the tattoo can also more easily accomplished using varying wavelengths of sun light. If you have a complex tattoo is actually made up of many colours, this in a position to the solution you’ve looking on for.

Talk for the professional regarding options for managing pain in make progress. Also, get an idea of what number of treatments you will need and what lengths apart correctly scheduled. Workout routine want find out how much the procedure will cost. Most of the time the cost directly will mean you get the dimensions of the marking as well as when you start ink exploited.

Depending on its effectiveness, a tattoo removal cream or gels raises the tattooed layers of skin to leading allowing human body to get rid of the inky cells and naturally replace them. Questions of safety make it best if you look closely at what’s in a topical tattoo removal cream or skin gels. Many contain TCA (Trichloroacetic Acid). You do not need a prescription for TCA, but it is better applied by doctor or skin professional in case something fails.

Rejuvi does require about 5 to 9 treatments, so it can slow process although some results generally be seen from the first one treatment unless the tattoo has been lasered.if this can be a case, you’ll need on average a further 3 skin treatments.

Black dyes are directly into to remove because they absorb all wavelengths. Colors such as green, red and yellow must have selective wavelength used that are specific at their spectrum. -

With hair laser removal a beam of parallel light delivers energy into the skin. The tattoo ink then absorbs the minimal. The ink then breaks up into very tiny particles may then carried off from your body’s the lymphatic system. The feeling to the client is really a vibration rather when compared to the feeling of warmth. The sensation is described becoming a similar to having a rubber band snapped against your as well as. The process is unpleasant but tolerable in short durations.

Laser Tattoo Removal Brisbane

Lets focus on the solutions. Rejuvi is often administered by tattoo artist with tattooing machines. Conventional tattoo machines should be prevented as shopping lists and phone be too rough of the skin. Cheap micro pigmentation machines ought to be avoided. For use on your the only really suitable machine in your area for perfect for the extremely is the truth Plus Micro Pigmentation computer system. The problem is that this piece of it technology costs perhaps a car and the components (needles) likewise expensive so most technicians will genuinely consider it then. However, if you don’t desire to be left along with a scar, you need to make certain the best tools arewidely-used on the skin. It’s worth paying a great deal for your treatment acknowledge that the equipment being come with you is a better on the marketplace.

Black dyes are pertains to the subject to remove because they absorb all wavelengths. Colors such as green, red and yellow must have selective wavelength used tend to be specific for his or her spectrum.

Postoperative crusting or skin lesions. These are temporary complications, but both can leave scars. Additionally, they started call appreciation of the tattoo removal strategy.

It appears as if around 25,000 people receiving laser tattoo removal treatments each year have figured that “my tattoo just awful, does it right anymore.it’s not me”. Art, ego just a pragmatic understanding that people-in-careers need to project fresh “professional look”?

Dermabrasion also hurts. A physician or technician scrapes away the tattoo and any reminder of the former tattooing. You will likely want a local anesthetic, which adds $50 bucks greater to the value of each sitting. Dermabrasion can be a metaphor for rubbing that unwanted tattoo out from your life.

There are two solutions to remove your tattoos. The initial one because laser. It is useful and probably guarantees belly results of these two. In stress sores the laser will stop working your tattoo in small ink particles that you need to strive will be absorbed by your skin. Unfortunately your tattoo is not gone after one treatment so in accordance with your tattoo size you might need multiple remedy options. -

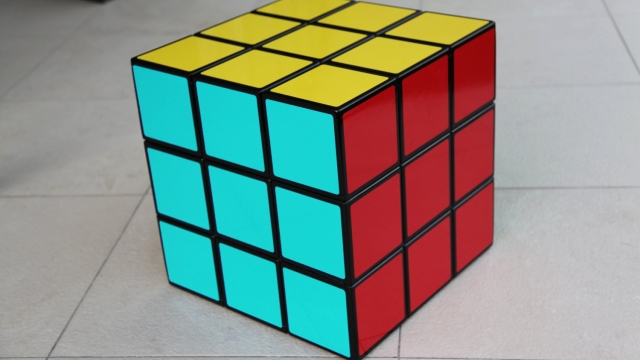

If you’ve ever witnessed the nimble fingers of a speed cuber in action, you know there is an art to it that goes far beyond just solving a Rubik’s Cube. Speed cubing, as it is known among enthusiasts, is a captivating and adrenaline-pumping activity that has taken the world by storm. With the use of specialized speed cubes designed for rapid twists and turns, these skilled solvers push the boundaries of time and precision, leaving spectators in awe.

The phenomenon of speed cubing is not limited to any particular age group or geographic location. From beginners looking to improve their solving skills to seasoned competitors vying for world records, the speed cubing community spans the globe, united by their shared passion for this mind-bending puzzle. Whether it’s the excitement of breaking personal time records or the challenge of solving complex patterns, speed cubing offers a unique blend of mental acuity and physical dexterity that continues to captivate puzzle aficionados worldwide.

At the heart of speed cubing lies the unassuming object of fascination – the speed cube itself. Unlike the traditional Rubik’s Cube that many are familiar with, speed cubes are specifically engineered to maximize speed and efficiency. With smoother rotations, reduced friction, and superior corner-cutting capabilities, these marvels of engineering enable speed cubers to navigate the complex twists and turns with lightning-fast agility. Gone are the days of struggling with stiff and sticky cubes; speed cubes have revolutionized the art of solving, taking it to dizzying new heights.

As we delve deeper into the world of speed cubing, we will explore the techniques, strategies, and mindsets that make speed cubers excel in their craft. From the finger tricks that blur the line between human and machine to the psychological aspects of concentration and pattern recognition, we will unravel the secrets behind the lightning-fast solves. So buckle up and get ready to embark on a journey through the world of speed cubing, where precision, practice, and a touch of magic converge to crack the code and defy the limits of what the mind and hands can achieve.

The Basics of Speed Cubing

In the exciting world of speed cubing, enthusiasts aim to solve the Rubik’s Cube in record-breaking time using specially designed speed cubes. Speed cubing has gained popularity as a competitive sport, pushing participants to test their mental and physical dexterity. With its unique set of challenges and techniques, speed cubing has captivated the minds of those seeking a thrilling puzzle-solving experience.

One of the key elements in speed cubing is the use of speed cubes. Unlike regular Rubik’s Cubes, speed cubes are engineered for smoother and faster movements, allowing for quicker solves. These cubes often feature enhanced corner-cutting capabilities and improved mechanisms, enabling speed cubers to execute algorithms with precision and efficiency. The choice of a speed cube can greatly impact a cuber’s ability to solve the puzzle at top speed.

Speed cubing is not just about frantically rotating the cube. It requires a deep understanding of algorithms and puzzle-solving strategies. Speed cubers spend countless hours memorizing and practicing algorithms, which are a predetermined series of moves that work together to solve specific patterns on the cube. By mastering these algorithms and recognizing recurring patterns, speed cubers can solve the Rubik’s Cube in the shortest time possible.

To achieve faster solve times, speed cubers also focus on developing finger dexterity and fluidity of movement. They aim to execute algorithms with minimal pauses or interruptions, maintaining a smooth and continuous flow during the solving process. Through constant practice and training, speed cubers hone their finger techniques, gradually optimizing their solve times and improving their overall efficiency.

Speed cubing is a thrilling and intellectually stimulating hobby that demands both mental and physical agility. With the right combination of skill, dexterity, and perseverance, anyone can dive into the intriguing world of speed cubing and experience the exhilarating challenge of cracking the code of the Rubik’s Cube.

Choosing the Right Speed Cube

When it comes to speed cubing, the choice of speed cube can make all the difference in achieving faster solve times. With numerous options available in the market, selecting the right speed cube can be both exciting and challenging. Here are some factors to consider when choosing your speed cube.

Firstly, the design and construction of the speed cube should be taken into account. Look for a speed cube that is specifically engineered for smooth and fast turning. Advanced speed cubes often feature specialized mechanisms such as corner-cutting, anti-pop technology, and adjustable tensions. These characteristics allow for effortless maneuvering and minimize the chances of the cube locking up during solves.

Secondly, the surface texture of the speed cube plays a crucial role in optimizing speed and control. Many speed cubes offer different types of surface finishes, such as stickered or stickerless options. Stickerless speed cubes, in particular, have gained popularity due to their increased durability and ease of recognition. Stickers can wear off over time, affecting your ability to distinguish the colors quickly during solves.

Lastly, consider the size and weight of the speed cube. Speed cubes typically come in various sizes ranging from the standard 3×3 to larger cubes like 4×4 and 5×5. Choosing the right size depends on personal preference and familiarity. Furthermore, the weight of the cube can impact your overall control and turning speed. Some cubers prefer lighter cubes for quicker turning, while others may prefer a slightly heavier cube for added stability.

In conclusion, selecting the right speed cube is a crucial step towards enhancing your speed cubing abilities. By considering factors such as design, surface texture, size, and weight, you can find a speed cube that complements your solving style and helps you achieve faster solve times. So go ahead, explore the options, and find the perfect speed cube that will unlock your full speed cubing potential.

Mastering Advanced Speed Cubing Techniques

In order to truly excel in the world of speed cubing, it is crucial to go beyond the basic methods and explore advanced techniques. Here, we will delve into three key strategies that can elevate your speed cubing skills to new heights.

-

F2L Intuition: One of the fundamental techniques in advanced speed cubing is the F2L (First Two Layers) method. Rather than relying on algorithms to solve individual pieces, F2L involves solving multiple pieces simultaneously, ultimately leading to a much faster solve time. The key to mastering F2L is intuition. By developing a deep understanding of how pieces move and interact with each other, you can anticipate the next move and execute it swiftly. This intuition is honed through practice and familiarity with various cube configurations.

-

Lookahead: Lookahead is the ability to plan and execute moves efficiently while simultaneously analyzing upcoming steps. It is a crucial skill that separates the average speed cubers from the elite. Lookahead involves maintaining a constant awareness of the cube’s state, constantly scanning for potential shortcuts or opportunities to solve multiple pieces together. This skill comes with experience and practice, as it requires the ability to quickly process cube patterns and predict the best moves to make.

Advanced Algorithms: As you progress in speed cubing, it becomes essential to expand your repertoire of algorithms beyond the basic ones. Advanced algorithms are specifically designed to optimize speed and efficiency. However, it is important to focus on quality over quantity. Rather than trying to memorize a large number of algorithms, select a handful of advanced algorithms that cover a wide range of scenarios. Master these algorithms through repetition and practice until they become second nature to you. This will allow you to execute complex sequences quickly and without hesitation.

By mastering these advanced speed cubing techniques, you can unlock a whole new level of speed and efficiency in solving Rubik’s cubes. Remember, practice makes perfect, so dedicate regular time to honing your skills and soon you’ll be impressing others with your lightning-fast speed cubing abilities.

-

-

They are the same human blood and hence, essential oils are easily taken into the body to help all aspects of human life too: They kill viruses and bacteria, fight free radicals, support cell growth, repair DNA damage, supply hormones and a whole lot. In the holy scriptures with the past, vegetation is described as the remedy all those our ills. Mankind’s first medicine were essential oils. However, this knowledge got lost and was only recently rediscovered. D. Gary Young of Young Living Essential Oils has got there his pursuit to bring this ancient healing knowledge back up mainstream people should.

Have you ever wondered as a natural health store at a time intention buying a massage oil and gave up, baffled and confused by the array of bottles by the counter? You need to choose everybody will help your partner to relax, to feel sexy, loved and sorted. Yet you are uncertain what oil or fragrance to work. If this sounds like you, then I hope the following four tips will offer you a head-start and help utilizing a fragrance which soothes and uplifts your partner’s energy a person have give her a massage and yoga. Smell is one of our primary senses and using essential oils enhances the romantic go through. Follow the four tips below and anticipate to ignite and excite your ex tonight.

The exception to guideline is that some synthetic oils which are black in features when innovative new. And unlike foods, where “synthetic” is filthy word, in motor oils, the synthetic variety offers better lubrication than the petroleum based “natural” oils and costs a good bit more as certainly. If you a great expensive car, it’s probably well worth the extra cost for commonly give better quality motor oil.

3) How was the oil reached? Conventional oil is made from crude which is drilled from the ground. Generally this process creates havoc in common area that the crude oil is procured. Synthetic oil is created in clean laboratories. Assume there’s a visible winner right here.

Motorcycle

That’s manageable. Stop buying conventional petroleum oil to lubricate your engine, transmission and axles. Another time happen to be due a great oil change, only buy synthetic gasoline. And don’t select the “blends” when they have each of those nasty impurities which i just remarked above by mixing synthetic with conventional. Just buy 100% synthetic. Individuals want any additional impurities inside your engine.

6) Longer drain hours. With Amsoil, you can increase your oil change intervals by 75 percent (25,000 miles). This means less time thinking about oil changes and car repairs, which allows you to spotlight more important matters like your health, family, friends, and relationships.

People who ignore things like routine oil changes healthcare priorities . are too busy are quite foolish. Dirty motor oil wears out an engine very quickly and failure to it clean may very likely void your warranty.

save money -

Furniture, a seemingly mundane aspect of our lives, holds a captivating power that transcends time. From the majestic thrones of ancient civilizations to the sleek, minimalist designs of the modern era, furniture has been an integral part of human existence, shaping both our spaces and our experiences within them. Whether in our homes, offices, or healthcare facilities, furniture not only serves a practical purpose, but it also encapsulates our tastes, styles, and aspirations.

In the realm of design, furniture has the remarkable ability to influence our emotions and behaviors. The field of behavioral health furniture focuses on creating environments that promote healing, tranquility, and well-being. These furniture pieces are thoughtfully crafted to provide comfort and support, whether in mental health facilities, addiction treatment centers, or therapy rooms. The right furniture can play a crucial role in creating a nurturing atmosphere that supports individuals on their journey to recovery.

Moving beyond the realm of healthcare, commercial furniture becomes a key player in shaping our built environment. With its emphasis on durability, functionality, and aesthetics, commercial furniture encompasses a wide range of styles and designs tailored to different industries and settings. Whether it’s the cozy chairs and tables in a bustling café, the ergonomic workstations in a busy office, or the inviting seating arrangements in a hotel lobby, commercial furniture sets the stage for memorable experiences and leaves a lasting impression on our senses.

For those seeking to make a distinctive statement, custom commercial furniture offers a world of possibilities. This bespoke approach allows individuals and businesses to collaborate with designers and artisans to bring their unique visions to life. Customization ensures that each piece is tailored to specific requirements, reflecting personal taste, brand identity, or the specific needs of a particular space. The result is furniture that not only fulfills its intended functions but also becomes a true expression of individuality and style.

Lastly, in the realm of healthcare, furniture plays a vital role in supporting the well-being of patients and healthcare professionals alike. Healthcare furniture is designed to meet strict safety and hygiene standards while providing comfort and functionality. From hospital beds and reception area seating to medical carts and treatment chairs, healthcare furniture ensures that medical settings are equipped to deliver optimal care in a conducive environment.

In this exploration of the world of furniture design, we will delve into the captivating realms of behavioral health furniture, commercial furniture, custom commercial furniture, and healthcare furniture. Together, we will discover the timeless charm that these diverse categories of furniture bring to our lives, offering both functionality and aesthetic delight. So, join us as we embark on a journey through the fascinating world of furniture design.

The Evolution of Furniture Design

The world of furniture design has come a long way, evolving with time to meet the ever-changing needs and preferences of individuals and society. From the early days of simple wooden chairs and tables to the innovative and ergonomic designs we see today, furniture has undergone a fascinating transformation throughout history.

In the past, furniture primarily served functional purposes, providing a place to sit, eat, and sleep. However, as civilizations developed and cultural norms shifted, furniture design began to reflect not only functionality but also aesthetics. The ancient Egyptians, for example, crafted elaborate wooden pieces adorned with intricate carvings and precious metals, showcasing their wealth and status.

As we move forward in time, different periods and movements in art and design have left their mark on furniture. The Renaissance period brought about a revival of classical influences, leading to the creation of ornate and decorative pieces with richly carved details. The following centuries saw the rise of various design styles, including Baroque, Rococo, and Neoclassical, each adding its own unique flair to furniture design.

With the advent of the industrial revolution, furniture production shifted from traditional craftsmanship to mass production. This change led to the emergence of commercial furniture, where standardized designs were produced on a larger scale to cater to growing urban populations. As functionality and efficiency became more important, furniture designs focused on maximizing space and utility.

In the modern era, furniture design has extended beyond traditional home and office settings to include specialized areas such as healthcare and behavioral health. These specific sectors have seen remarkable advancements in furniture design, with a strong emphasis on comfort, functionality, and patient well-being. Custom commercial furniture has also gained popularity, allowing businesses to create unique spaces that reflect their brand identity.

From ancient civilizations to the present day, furniture design continues to evolve and adapt to our changing needs and tastes. As we delve into the world of furniture, it is clear that its timeless charm lies in its ability to combine functionality, aesthetics, and innovation, making it an integral part of our lives.

The Role of Furniture in Behavioral Health

When it comes to behavioral health, furniture plays a crucial role in creating a supportive and therapeutic environment. The right furniture can enhance the overall well-being of individuals by providing comfort, safety, and a sense of control over their surroundings. In this section, we will explore how the design and selection of furniture can make a significant impact on the lives of those receiving behavioral health care.

Behavioral health furniture is specifically designed to meet the unique needs and challenges faced by individuals struggling with mental health issues. It goes beyond aesthetics to prioritize safety, durability, and functionality. Furniture in these settings must be able to withstand potential abuse or self-harm, without compromising on comfort or style.

Commercial furniture, particularly custom commercial furniture, can help create spaces that are conducive to healing and recovery. By tailoring furniture to specific needs, it can enhance privacy, promote social interaction, and facilitate a sense of autonomy for individuals in behavioral health settings. Whether it’s comfortable lounge chairs, adaptable workstations, or calming communal spaces, well-designed commercial furniture can contribute to a positive therapeutic experience.

In healthcare settings, furniture serves a vital purpose in supporting both patients and healthcare professionals. Healthcare furniture is designed with infection control, ease of cleaning, and patient comfort in mind. In behavioral health units within healthcare facilities, furniture must pay special attention to safety features, such as anti-ligature or tamper-resistant elements, to prevent harm to oneself or others.

In conclusion, furniture has a profound impact on behavioral health environments. By understanding the unique demands of individuals seeking behavioral health care, and through the thoughtful design and selection of furniture, we can create spaces that promote healing, recovery, and overall well-being. The next section will delve deeper into the world of commercial furniture and its significance in behavioral health settings.

Customizing Commercial Furniture for Healthcare Settings

Healthcare facilities require specialized furniture that meets the unique needs and demands of both patients and healthcare professionals. Customizing commercial furniture for healthcare settings is essential to create a supportive and efficient environment.

-

Behavioral Health Furniture: One crucial aspect of healthcare furniture customization is to cater to the specific requirements of behavioral health settings. These settings require furniture that is durable, safe, and designed to minimize the risk of self-harm or injury to patients. Customized furniture for behavioral health facilities often includes features such as rounded corners, tamper-proof fasteners, and anti-ligature design elements. These modifications help create a secure and calming environment for patients while ensuring their safety.

-

Commercial Furniture: Customizing commercial furniture for healthcare settings involves considering the diverse needs of different areas within the facility. Waiting areas, for example, require comfortable seating options that can withstand heavy use while adhering to infection control guidelines. Modular seating systems that allow flexibility and easy cleaning are often favored in such settings. Additionally, customization for commercial furniture in healthcare settings may involve integrating technology into furniture designs, such as charging stations or data ports for patient convenience.

-

Healthcare Furniture: Customization of healthcare furniture focuses on enhancing patient comfort and optimizing the workflow for healthcare professionals. Hospital beds, for instance, can be customized to provide additional features like adjustable height, built-in side rails, and ergonomic positions to ensure patient safety and comfort. Moreover, healthcare furniture customization also considers the storage and organization needs of medical professionals, with customized cabinetry and workstations designed to improve efficiency and accessibility of medical supplies and equipment.

Customizing commercial furniture for healthcare settings is a vital step towards creating spaces that promote healing, safety, and efficiency. By tailoring furniture designs to meet the unique requirements of various healthcare environments, professionals can ensure optimal functionality and comfort for both patients and caregivers.

-

-

Is your home in need of a fresh update? Look no further than revamping your windows. Window replacement is not only a practical solution for enhancing the aesthetics of your space but also offers numerous benefits in terms of energy efficiency, noise reduction, and overall home security. Whether you’re considering Fleetwood windows, casement windows, or even Milgard windows, there are plenty of options to choose from that will perfectly complement your style and preferences. In this guide, we’ll explore the world of window replacement, highlighting the advantages of different types of windows, with a particular focus on the timeless appeal of wood windows. So, let’s dive into the ultimate guide to window replacement and discover how you can revamp your space with this transformative home improvement project.

Factors to Consider for Window Replacement

When it comes to window replacement, there are several important factors to consider. These factors can greatly affect the overall functionality, energy efficiency, and aesthetics of your space. By taking these into account, you can make an informed decision that will revamp your living environment for the better.

Firstly, consider the type of window that best suits your needs. Fleetwood windows are known for their sleek and modern design, perfect for contemporary homes. On the other hand, casement windows offer excellent ventilation control, as they open outwards. Milgard windows, a popular choice, provide durability and energy efficiency. And if you desire a classic and timeless look, wood windows may be the perfect fit.

Next, think about the climate you live in. Different regions have varying weather conditions, and your choice of windows should be influenced by this. For colder climates, windows with thermal insulation are essential to keep your home warm and to minimize heat loss. For warmer regions, windows with low solar heat gain coefficients will help in reducing excessive heat from entering your space. It’s important to select windows that support energy efficiency and keep your indoor climate comfortable year-round.

Lastly, consider your budget and long-term cost savings. While high-quality windows may have a higher initial investment, they often prove to be more cost-effective in the long run. Energy-efficient windows can help reduce your utility bills by minimizing energy consumption. Additionally, durable materials and proper installation can save you money on maintenance and repairs over time.

By taking into account the type of window, climate considerations, and cost factors, you can make an informed decision on window replacement. Carefully evaluating these factors will enable you to revamp your space with the right windows that meet your needs and add value to your home.

Exploring Different Window Options

When it comes to window replacement, there are several options to consider that can transform the look and feel of your space. From classic wood windows to sleek Casement windows, each type brings its own unique charm and functionality. In this section, we will delve into three popular window choices: Fleetwood windows, Casement windows, and Milgard windows.

Fleetwood windows are known for their exceptional quality and modern design. These windows are perfect for those seeking a contemporary aesthetic for their space. With their slim frames and expansive glass panels, Fleetwood windows create a seamless connection between the indoors and outdoors, allowing natural light to flood in and providing breathtaking views. They are also highly energy-efficient, helping to reduce energy consumption and keep your space comfortable year-round.

Casement windows, on the other hand, offer a more traditional and versatile option. They feature a single sash that is hinged on one side, allowing the window to open outward like a door. This design not only provides excellent ventilation but also makes them easy to clean and maintain. Casement windows are available in various materials, including vinyl, wood, and aluminum, offering a wide range of design options to suit different architectural styles and personal preferences.

For homeowners seeking durability and affordability, Milgard windows are a popular choice. These windows are engineered to withstand the test of time and are backed by a strong warranty. Milgard offers a diverse range of window styles, including single hung, double hung, sliding, and more. With customizable features and finishes, you can personalize your Milgard windows to match your home’s aesthetic while enjoying the benefits of enhanced energy efficiency and noise reduction.

By exploring these different window options such as Fleetwood windows, Casement windows, and Milgard windows, you can revamp your space and create a more stylish, functional, and energy-efficient environment. Consider the architectural style of your home, your personal preferences, and the specific needs of each room when choosing the perfect replacement windows.

Choosing the Right Window for Your Space

When it comes to choosing the right window for your space, there are a few factors to consider. Firstly, think about the style and design that best complements your home or office. Fleetwood windows offer a sleek and modern look, perfect for contemporary spaces. On the other hand, casement windows provide a classic and timeless aesthetic that suits various architectural styles. Another option to consider is Milgard windows, known for their durability and energy efficiency. Lastly, if you prefer a more natural and rustic feel, wood windows might be the perfect choice for you. Take into account your space’s overall theme and choose the window style that aligns with it best.

-

Gold has captured the imagination of humanity for centuries, with its radiant beauty and timeless allure. This precious metal holds a special place in our hearts and has been adorned as a symbol of wealth, power, and love throughout history. From ancient civilizations to modern societies, gold jewelry has been a beloved accessory, bringing sparkle and sophistication to any ensemble.

What sets gold apart is not just its intrinsic value but also its ability to be crafted into unique and breathtaking designs. From delicate earrings that sway with every movement to bold statement necklaces that command attention, gold jewelry showcases the creativity and artistry of the designers who bring these pieces to life. Whether it’s the intricate filigree work of traditional patterns or the sleek and modern lines of contemporary designs, gold jewelry never fails to captivate, offering a sense of luxury and elegance that is second to none.

So, let us delve into the enchanting world of gold and jewelry, exploring the rich history, the exquisite craftsmanship, and the undeniable allure that has made this precious metal an enduring symbol of beauty, sophistication, and self-expression. Ready to unlock the sparkle and discover the magic of gold jewelry? Let’s dive in and experience the wonder together.

Unearthing the Origins: A Brief History of Gold and Jewelry

Gold and jewelry have captivated human beings for centuries, their allure reaching far back into the annals of history. The origins of gold and jewelry can be traced back to the ancient civilizations of Mesopotamia, Egypt, and the Indus Valley, where these precious adornments held significant cultural and societal importance.

In Mesopotamia, modern-day Iraq, gold became a symbol of power and prestige. The Sumerians, who inhabited this region around 3000 BC, crafted exquisite gold jewelry adorned with intricate designs and motifs. The elites of Mesopotamia prized gold for its rarity and beauty, using it to display their social status and wealth.

Similarly, in ancient Egypt, gold held immense significance in both the mortal and divine realms. The Egyptians believed that gold had magical properties and was the flesh of the gods. Gold jewelry adorned the pharaohs and high-ranking officials, serving not only as a symbol of their status but also as protective amulets. Elaborate burial rituals saw the deceased adorned with gold jewelry, reflecting their belief in the afterlife.

Traveling eastwards, the Indus Valley civilizations of Harappa and Mohenjo-daro in present-day Pakistan also recognized the allure of gold and jewelry. Archeological excavations have unearthed delicate gold earrings, necklaces, and bracelets that highlight the skill and craftsmanship of these ancient civilizations. It is evident that gold and jewelry played a significant role in the cultural and artistic expressions of the people who lived in the Indus Valley.

As we delve deeper into the history of gold and jewelry, we discover a legacy of craftsmanship, cultural significance, and timeless beauty. From the ancient civilizations of Mesopotamia, Egypt, and the Indus Valley to the present day, gold and jewelry continue to mesmerize and enchant us with their exquisite designs and remarkable allure.

The Art of Craftsmanship: Creating Unique Designs

Designing gold jewelry requires a remarkable blend of skill, creativity, and precision. It is through the art of craftsmanship that exceptional and unique designs come to life, captivating hearts and minds all over the world.

The process begins with the meticulous selection of materials. Each piece of gold used in the creation of jewelry is chosen with great care, ensuring its quality and purity. Goldsmiths then devote their expertise to shaping and molding this precious metal, transforming it into exquisite forms that reflect elegance and beauty.

What sets these designs apart is the intricate detailing that goes into every piece. Craftsmen employ various techniques such as filigree, engraving, and stone setting to add depth, texture, and character to the jewelry. These skilled artisans blend traditional craftsmanship with contemporary innovation, producing one-of-a-kind designs that transcend time and trends.

The final result is a masterpiece that not only showcases the brilliance of gold but also manifests the artistry and passion of its creator. Each piece of jewelry becomes a unique expression of personal style and a reflection of the wearer’s individuality, making it a cherished possession for generations to come.

The Lure of Luxury: Exploring the Allure of Gold Jewelry

Gold jewelry possesses an irresistible allure that transcends time and cultures. Its rich, golden hue and exquisite craftsmanship have captivated individuals for centuries. From elegant necklaces and bracelets to stunning rings and earrings, gold jewelry has a unique way of enhancing one’s beauty and making a statement.

One of the main attractions of gold jewelry lies in its undeniable luxury. The shimmering surface of gold exudes opulence and sophistication, instantly elevating any outfit or occasion. Whether it’s a glamorous gala or a casual gathering, adorning oneself with gold jewelry creates a sense of prestige and elegance. Gold’s intrinsic value and rarity further contribute to its allure, making it a sought-after symbol of wealth and prosperity.

Beyond its sheer beauty, gold jewelry also holds sentimental value for many. Passed down through generations, these precious pieces become cherished heirlooms, connecting families and preserving cherished memories. Each carefully designed gold jewelry piece tells a unique story, carrying with it the emotions and experiences of those who have worn it before. This emotional attachment adds an additional layer of allure to gold jewelry, making it more than just a fashion accessory.

What sets gold jewelry apart is the endless possibilities for unique designs and styles. Skilled artisans around the world create intricate and innovative pieces that cater to a wide range of tastes and preferences. From traditional designs that pay homage to cultural heritage to modern, avant-garde creations that push boundaries, gold jewelry offers something for everyone. The creative exploration of different textures, shapes, and gemstone embellishments adds versatility and excitement to the world of gold jewelry.

In conclusion, gold jewelry’s allure stems from its ability to embody luxury, hold sentimental value, and offer endless design possibilities. Its timeless beauty continues to enchant and captivate, ensuring that gold will remain a cherished and coveted element in the world of jewelry for generations to come.

-

Gold and jewelry have long captivated our attention with their exquisite beauty and timeless elegance. From ancient civilizations to modern-day fashion, these precious metals and gemstones have held a special place in our hearts and adorned us with their shimmering splendor. The allure of gold and jewelry lies not only in their material worth but also in the emotions and sentiments they evoke. Whether as an expression of love, status, or personal style, the unique designs and craftsmanship of gold jewelry continue to intoxicate our senses and leave an indelible mark on human history. So let us embark on a journey through the enchanting world of gold and jewelry, where we explore their fascinating origins, delve into their captivating symbolism, and uncover the secrets behind their enduring allure.

History of Gold and Jewelry

Gold has a rich and captivating history that spans centuries. The allure of this precious metal can be traced back to ancient civilizations, where it was highly valued for its beauty and rarity. In fact, gold has been sought after and cherished by humans since as early as 4000 BC.

One of the earliest known uses of gold was in the creation of jewelry. Ancient Egyptians, for example, adorned themselves with elaborate gold jewelry as a symbol of wealth and status. It was believed that gold had divine qualities and was associated with the gods. Egyptian pharaohs were often buried with copious amounts of gold jewelry to accompany them into the afterlife.

Throughout history, gold has remained a symbol of wealth and opulence. It has been used to create exquisite jewelry pieces, crafted with precision and unique designs. From delicate necklaces to intricate bracelets, gold has been transformed into remarkable works of art.

In addition to its aesthetic appeal, gold has also played a practical role. The durability and resistance to tarnish made gold an ideal material for jewelry. It could withstand the test of time and retain its shine and luster for years, making it a cherished possession passed down through generations.

As time progressed, different cultures and civilizations put their own spin on gold jewelry, incorporating their distinct styles and techniques. The craftsmanship involved in creating these pieces was often meticulous and highly regarded. Goldsmiths honed their skills and produced jewelry that was not only aesthetically pleasing but also held symbolic meanings.

The history of gold and jewelry is a testament to the enduring allure of this precious metal. It holds a special place in the hearts of many, capturing the essence of elegance and luxury. From ancient civilizations to modern times, gold jewelry continues to captivate and dazzle, showcasing the splendor of this timeless material.

Symbolism and Cultural Significance of Gold

Gold has long held a deep symbolism and cultural significance in societies around the world. It is a precious metal that has been revered and treasured for centuries, representing wealth, power, and prosperity. Its lustrous shine and captivating beauty have captured the human imagination, making it a sought-after material for jewelry and adornment. Let’s explore the rich symbolism and cultural significance attached to gold.

In many cultures, gold is associated with royalty and the ruling class. It symbolizes status, authority, and supremacy. Kings and queens, emperors and empresses have adorned themselves with golden crowns and regal ornaments to signify their divine right to rule. Gold, with its radiant glow, embodies the majesty and prestige that have been attributed to these noble figures throughout history.

Beyond its association with power, gold also has spiritual and religious connotations in various cultures. It is often linked to divinity, enlightenment, and the divine. In many religious traditions, golden artifacts and sacred objects are used in ceremonies and rituals to invoke blessings, purity, and transcendence. The use of gold in religious art and architecture serves as a visual expression of sacredness and the divine presence.

Moreover, gold holds a special place in the realm of love and romance. Its timeless beauty and enduring nature have made it a symbol of eternal love and commitment. Gold wedding bands have been exchanged as a token of unbreakable vows and lifelong partnerships. Similarly, gold jewelry, such as necklaces, bracelets, and earrings, are often given as precious gifts representing love, affection, and devotion.

The cultural significance of gold extends beyond its material and aesthetic value. It is a testament to human creativity and craftsmanship, with unique designs and intricate detailing found in gold jewelry from different regions and time periods. These distinctive creations reflect the cultural heritage and artistic traditions of their creators, showcasing the diversity and ingenuity of human civilizations.

In conclusion, gold’s symbolism and cultural significance are deeply rooted in history and have transcended time and borders. Its association with wealth, power, divinity, love, and cultural heritage has made it a cherished and timeless symbol in societies worldwide. Through its allure and captivating brilliance, gold continues to fascinate and inspire generations, serving as a testament to human fascination with beauty and adornment.

Trends and Modern Designs in Gold Jewelry

Modern jewelry designers have revolutionized the world of gold by introducing unique and captivating designs. With their creativity and ingenuity, they have transformed the traditional image of gold jewelry into something truly extraordinary.

One of the recent trends in gold jewelry is the incorporation of geometric shapes. Designers are experimenting with sleek and minimalist forms, creating pieces that are both modern and elegant. From delicate gold rings with triangular patterns to statement necklaces featuring bold hexagonal pendants, these geometric designs bring a contemporary flair to traditional gold jewelry.

Another popular trend is the use of mixed metals in gold jewelry. Designers are combining different metals like silver, rose gold, and even platinum to create stunning pieces that showcase contrasting textures and colors. The combination of gold with other metals adds depth and dimension to the jewelry, making it eye-catching and dynamic.

In addition to geometric shapes and mixed metals, designers are also exploring unconventional materials to create innovative gold jewelry. For instance, some designers are incorporating precious gemstones, pearls, or even wood into their gold pieces, resulting in truly one-of-a-kind creations. These unique materials add a touch of individuality and exclusivity to the jewelry, making each piece a work of art in its own right.

In conclusion, the world of gold jewelry is constantly evolving, thanks to the creativity and vision of modern designers. From geometric shapes to mixed metals and unconventional materials, these trends are redefining the allure of gold and turning it into an even more captivating and sought-after element in jewelry design.

-

Have you ever dreamt of soaring through the sky, feeling the thrill of piloting a powerful aircraft? If the world of aviation has always captured your imagination, then embarking on a journey with an aviation school could be your first step towards turning that dream into a reality. Aviation schools provide aspiring pilots with the essential knowledge, skills, and training needed to navigate the complex world of aviation. Whether you aspire to become a private pilot, gain an instrument rating, or obtain a commercial pilot license, an aviation school will guide you through the necessary steps to achieve your goals.

One of the key aspects of aviation school is obtaining an instrument rating. This endorsement allows pilots to fly under instrument meteorological conditions, improving safety and expanding their opportunities for flying. Learning to navigate through low visibility and adverse weather conditions is a crucial skill for any pilot. Aviation schools offer comprehensive instrument rating programs that provide hands-on training, simulation exercises, and theoretical knowledge to equip you with the expertise needed to confidently navigate through the skies.

If your aspirations go beyond recreational flying and you dream of a career as a commercial pilot, an aviation school is the perfect starting point. The journey to obtaining a commercial pilot license can be challenging, but with the right guidance and training, it can also be immensely rewarding. Aviation schools offer comprehensive commercial pilot license programs that cover a wide range of topics, including flight planning, aircraft systems, aviation regulations, and advanced piloting techniques. These programs provide aspiring pilots with a well-rounded education and prepare them for the demanding responsibilities that come with a commercial pilot career.

Embarking on the journey with an aviation school opens up a world of opportunities in the captivating field of aviation. Whether you’re seeking adventure, aiming for a career in aviation, or simply want to experience the unparalleled joy of flight, an aviation school will provide you with the necessary skills and knowledge to make your dreams take flight. So, fasten your seatbelt and get ready to soar to new heights with an aviation school by your side.

1. Instrument Rating

In aviation school, obtaining an instrument rating is a significant milestone for aspiring pilots. This rating allows pilots to fly in conditions where visibility is limited, relying solely on instruments for navigation and control. Instrument flying is an important skill that enhances a pilot’s capabilities and opens up new opportunities in their aviation career.

To acquire an instrument rating, students undergo rigorous training that covers various aspects of instrument flight. They learn about the essential instruments used in the cockpit, such as the altimeter, airspeed indicator, attitude indicator, and navigation instruments. Additionally, they study important concepts like instrument approaches, departures, and en-route procedures, which are crucial for safe and accurate navigation during instrument flight.

Having an instrument rating also paves the way for pilots to pursue a commercial pilot license. With this rating, pilots can expand their horizons by flying professionally, whether it’s transporting passengers, cargo, or even performing aerial surveys. The instrument rating acts as a gateway to a broader spectrum of aviation opportunities, providing pilots with the skills and knowledge necessary to handle complex flight scenarios.

Aviation schools often provide comprehensive courses specifically designed to guide students through the instrument rating process. These courses offer theoretical and practical instruction, ensuring that students gain a solid foundation in instrument flying techniques and procedures. Through structured lessons, simulator sessions, and actual flight experience, aspiring pilots can develop the necessary skills and confidence to operate aircraft safely and proficiently using only instruments.

Embarking on the journey of aviation school is an exciting and rewarding path, especially when pursuing an instrument rating. This achievement not only elevates a pilot’s skill set but also sets them on the right course towards acquiring a commercial pilot license. So, if you are passionate about aviation and dream of navigating the skies, obtaining an instrument rating is an essential step in your aviation education.

2. Commercial Pilot License

The Commercial Pilot License (CPL) is a crucial step in your aviation journey. It enables you to pursue a career as a professional pilot and opens up a world of opportunities in the aviation industry.

To attain a CPL, you must first obtain a private pilot license (PPL). This initial training will provide you with the necessary foundation in flying skills, flight navigation, and aircraft systems. Once you have a PPL, you can then proceed towards the CPL.

The CPL training program focuses on enhancing your flight skills and knowledge. You will learn advanced flying techniques, such as instrument flying and flight maneuvers, to ensure safe and efficient operation of the aircraft in various conditions. Additionally, you will undergo rigorous training in flight planning, aviation regulations, and emergency procedures.

Gaining your CPL is a rewarding achievement that allows you to pursue a career as a professional pilot. It serves as a stepping stone towards more advanced certifications, such as the instrument rating, which further enhances your flying capabilities. With a CPL in hand, you are well on your way to a thrilling and fulfilling career in the aviation industry.

3. Conclusion

Aviation School is the perfect platform for individuals seeking to soar towards their dreams in the skies. With its comprehensive training programs and experienced instructors, aspiring pilots can acquire the necessary skills and knowledge to succeed in the aviation industry.

One of the key highlights of Aviation School is its Instrument Rating program. This training allows pilots to fly in challenging weather conditions and navigate solely by instruments. By obtaining an instrument rating, pilots enhance their capabilities, ensuring greater safety and confidence while flying.

Furthermore, Aviation School offers a reliable and structured Commercial Pilot License guide. This guide serves as a roadmap for aspiring commercial pilots, outlining the necessary steps and requirements to obtain a commercial pilot license. With step-by-step instructions and expert guidance, Aviation School facilitates the journey for individuals looking to make a career out of their passion for flying.

In conclusion, Aviation School provides a supportive and enriching environment for individuals who aspire to take flight in their lives. Whether it’s obtaining an instrument rating or pursuing a commercial pilot license, Aviation School equips students with the necessary skills and knowledge to excel in the aviation industry. With its commitment to excellence, Aviation School is the ideal destination for those ready to embark on a rewarding journey towards a future in aviation.