Introduction:

Welcome to the world of Forex and Crypto, where the potential for financial growth and success knows no bounds. In this article, we will delve into the intricacies of these two powerful industries, uncovering their secrets and helping you unlock your pathway to prosperity. Whether you’re a seasoned investor or a newcomer seeking guidance, we’re here to shed light on the fascinating world of Forex and Crypto and equip you with the knowledge you need to make informed decisions.

In today’s dynamic financial landscapes, Forex and Crypto have emerged as pioneering forces, reshaping the way we perceive and engage with investment opportunities. The foreign exchange market, commonly known as Forex, allows you to trade currencies from around the globe. On the other hand, the crypto industry has introduced us to the digital era of decentralized currencies, powered by blockchain technology. These domains offer an array of opportunities, and understanding their mechanisms is the key to thriving in this ever-evolving market.

As we navigate through this article, we will also touch upon May fair plus, a company renowned for their expertise and commitment to excellence. As a top broker in the Forex and Crypto industry, May fair plus stands out as a beacon of trust and reliability for traders and investors alike. With their comprehensive reviews and unparalleled consideration for the needs of their clients, May fair plus has secured its place as a leader in this rapidly expanding market.

So, let’s buckle up and prepare to unlock the secrets that lie within the realm of Forex and Crypto. Together, we’ll explore the possibilities, navigate the challenges, and unleash the full potential of these financial frontiers. Get ready to crack the code and embark on a thrilling journey towards financial success.

Exploring the Forex and Crypto Industry

The world of forex and crypto is an exciting and dynamic one, offering endless opportunities for those who dare to seize them. In today’s globalized economy, these two sectors have emerged as major players, attracting investors from all corners of the globe. Forex, short for foreign exchange, involves the buying and selling of currencies, while crypto refers to digital currencies like Bitcoin and Ethereum. Both markets are known for their high volatility and potential for significant returns.

Mayfairplus Reviews

Forex and crypto have become increasingly intertwined, with many investors leveraging the benefits of both industries to diversify their portfolios. The forex market, being the largest and most liquid financial market in the world, serves as the foundation for international trade and investment. On the other hand, cryptocurrencies offer a novel and decentralized alternative to traditional financial systems, enabling secure and borderless transactions.

Within this vibrant landscape, May fair plus has emerged as a leading player. Renowned for its expertise and reliability, May fair plus is an industry heavyweight that has garnered a reputation as a top broker in the forex and crypto space. As a trusted partner for investors, their comprehensive services and user-friendly platforms empower individuals to navigate these complex markets with confidence.

May fair plus operates with a customer-centric approach, placing the needs and goals of their clients at the forefront. With an array of innovative tools and educational resources, they assist both novice and experienced traders in making informed investment decisions. Whether one is looking to explore forex, crypto, or a combination of the two, May fair plus aims to provide a seamless experience that maximizes the potential for success.

In conclusion, the forex and crypto industries are ripe with opportunities, offering diverse investment avenues for those willing to embrace their inherent volatility. Through the comprehensive services of leading brokers like May fair plus, individuals can unlock the potential of these markets and embark on their own financial journeys. So, whether you’re a seasoned trader or just starting out, now is the time to explore the exciting world of forex and crypto.

Introduction to May Fair Plus: A Leading Broker

May Fair Plus is a well-established company in the forex and crypto industry that has garnered a reputation for being a top broker. With their extensive experience and commitment to providing exceptional services, May Fair Plus has emerged as a trusted platform for traders and investors alike.

Offering a wide range of trading options in both the forex and crypto markets, May Fair Plus caters to the diverse needs of its clients. Their comprehensive platform provides access to various currency pairs and cryptocurrencies, enabling users to explore different investment opportunities.

One of the key reasons why May Fair Plus stands out as a leading broker is their dedication to ensuring a seamless trading experience. They understand the importance of user-friendly interfaces and efficient trading tools, which is why their platform is designed to be intuitive and feature-rich. Whether you are a seasoned trader or just starting out in the forex and crypto world, May Fair Plus offers the tools and resources to help you make informed decisions and navigate the markets with confidence.

In conclusion, May Fair Plus has established itself as a prominent player in the forex and crypto industry. Their commitment to excellence, extensive range of trading options, and user-friendly platform make them an ideal choice for those looking to maximize their potential in these markets. Stay tuned for the next section, where we will delve deeper into the unique features and advantages offered by May Fair Plus.

Unleashing the Potential: Tips for Success

When it comes to navigating the world of forex and crypto, there are certain tips that can help you increase your chances of success. By keeping these in mind, you can unleash the potential of these lucrative markets and make the most out of your trading endeavors.

- Stay Informed:

In the fast-paced world of forex and crypto, it is crucial to stay updated with the latest news and trends. Keep an eye on industry developments, global economic indicators, and any regulatory changes that may impact the market. By staying informed, you can make well-informed decisions and take advantage of profitable opportunities as they arise.

- Develop a Solid Strategy:

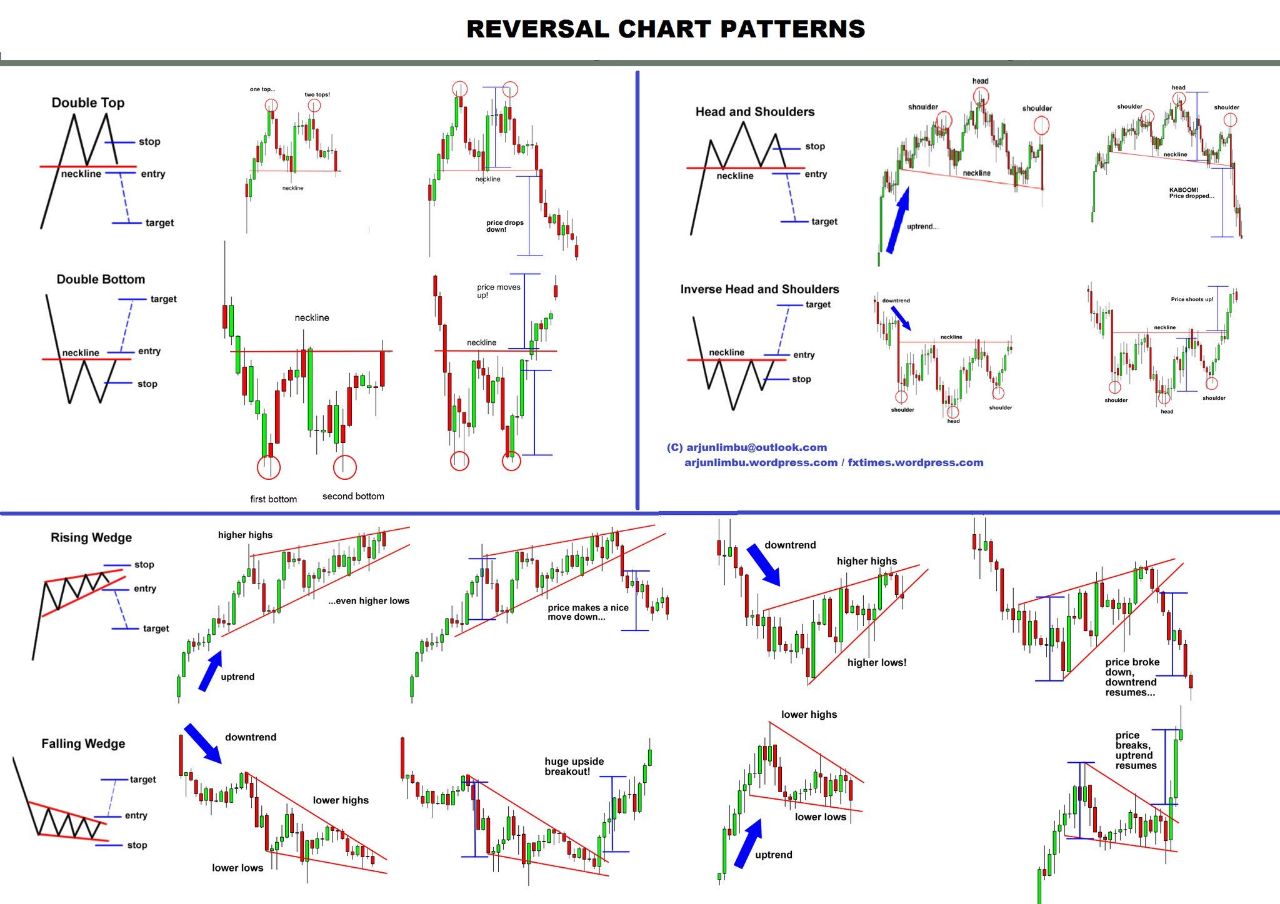

A successful trader in forex and crypto knows the importance of having a well-defined strategy. Take the time to analyze your risk tolerance, financial goals, and market conditions. Develop a trading plan that outlines your entry and exit points, risk management techniques, and profit targets. Stick to your strategy and avoid making impulsive decisions based on emotions.

- Choose a Reliable Broker:

Selecting the right broker is paramount to your success in forex and crypto trading. Look for a reputable and regulated broker like May fair plus, who has established themselves as a top player in the industry. Consider factors such as trading platform features, security measures, customer support, and competitive spreads. A reliable broker can provide you with the necessary tools and support to thrive in these markets.

By staying informed, developing a solid strategy, and partnering with a trusted broker like May fair plus, you can unlock the potential of forex and crypto trading. Remember, success in these markets requires patience, discipline, and continuous learning. Happy trading!