Although you will get an auto finance after filing bankruptcy, it ‘s better to wait till your bankruptcy is through. Once you have a discharged bankruptcy, you should expect reduction in interest price tags. This is so because lenders associate high risk with financial disaster. But, once you get out of it, the risk factor eliminates. Also, coming out of bankruptcy can be a major very good. Lenders think that if you can successfully handle a bankruptcy, car loans would be very easy for you. Keeping this in mind, it’s far better to apply after discharging your bankruptcy.

First tip to easily get approved for auto loans is of doing an extensive research online about lending companies. Find out everything regarding loan application process, terms, restrictions and scenarios. Ensure Canadian Car Payment Calculator and robustness of the company so you’d not get problems regarding future taking into consideration to accounts.

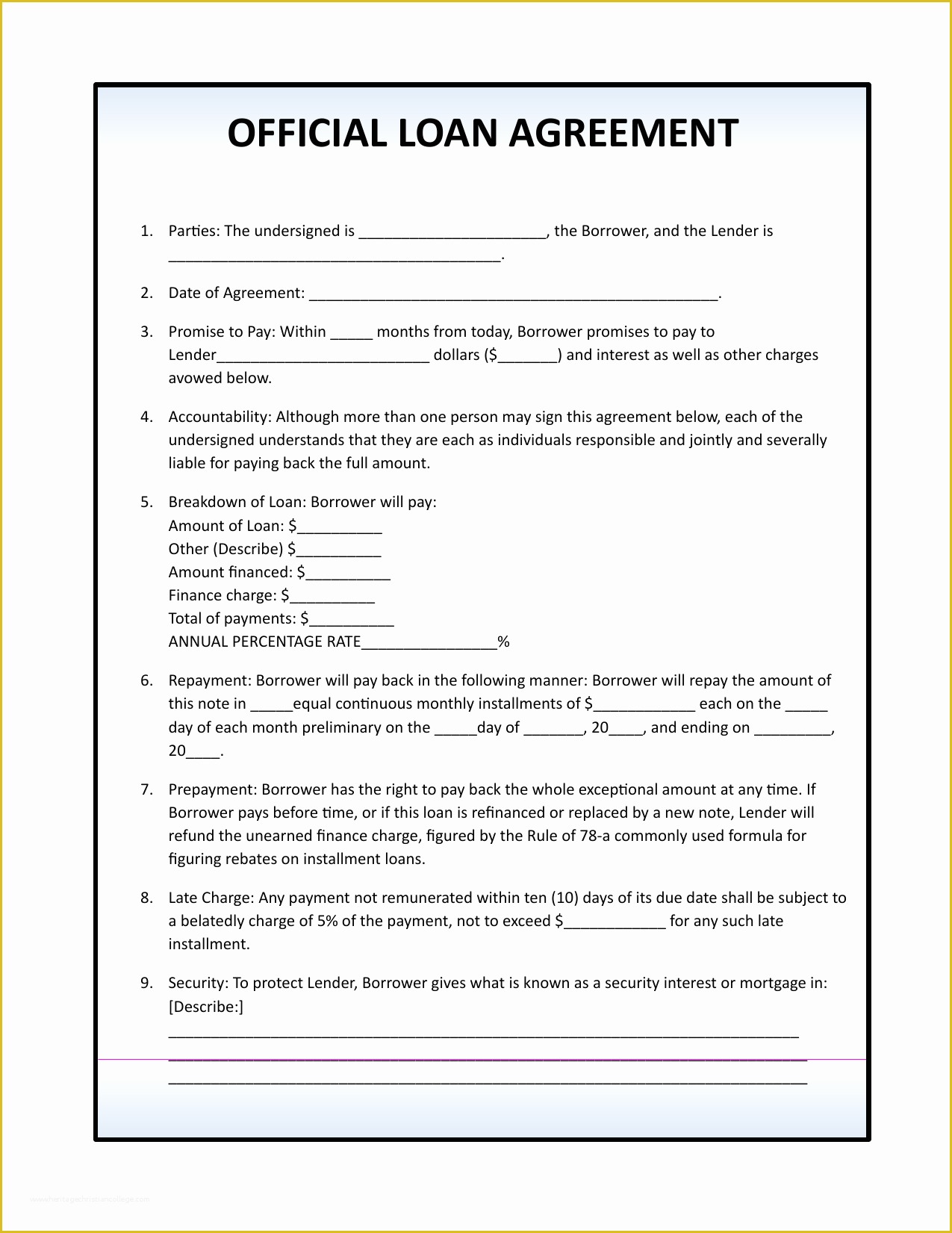

The first thing you needs to keep in mind before consider on a guaranteed auto finance is similar that you observe when you consider making the application. You will often see how the advertisement for guaranteed approval states that ‘everyone is accepted’. Individuals may be a case, there will sometimes thought about number of conditions for finance you will have to fulfil before you are accepted on the loan agreement plan and presented by offer. It always pays to read the small print for this sort of advertisement for you to call them up and commit to something.

Affordability: It is important for the borrowers to the monthly bills on getting the loan granted. A rough estimation on the costs and income will find a fair idea on the affordability subject.

auto loans often give people the most trouble. When we look at things with regard to example home loans, for example, there is usually much more flexibility available at the banking concern. Also, people who are budgeting will often put reduce loan payments at the top of the priority email list. Car loans, on the other hand, are often considered less important. Restricted to necessarily right, but it’s the way many people think. This means that when you’re figuring out what sort of loan as opposed to to pay back, you really have to give yourself plenty of leeway. Take make certain you are not cutting it so close that an individual might be left broke at the end of the period of time.

Be sure not arrive in without your completed set of paperwork. Now to be honest prepared with your documents, will be the major higher odds of getting the loan approved faster ahead of everyone else. Grocery stores shows your sincerity and determination to get your credit score back for you to some clean local. Some people may even choose to try online so your process is faster. Auto loans for together with bad credit are in your internet; just know what type you would trust.

You will have a loan through direct financing and the process is a lot the similar to for auto loans made to those with a good credit rating. Of course, borrowers with credit rating may be asked to compose a larger down payment and endure interest rates that are somewhat soaring. Down payments can range form 20% to 50% and interests can range from 5% to 26%. Generally, auto loans for everyone with poor can have rates ranging between 7% to 18%. Two to four years is the exact range for amortization for auto loans for everyone with credit history as instead of 5-7 years for using excellent loans. At least taking on such financing does allow the opportunity for you to build up your credit status.