Welcome to our guide on General Liability Insurance, an essential coverage for businesses of all sizes. In today’s fast-paced and unpredictable business landscape, it’s crucial to have a solid plan in place to protect your company from potential liability risks. From slip-and-fall accidents to data breaches, having adequate insurance coverage can provide peace of mind and shield your business from financially devastating consequences.

Commercial Insurance, specifically General Liability Insurance, serves as a safeguard against various liability claims. Whether your business operates in a physical location or primarily online, it’s vital to understand the scope and benefits of this insurance. It not only covers bodily injury and property damage claims but also includes legal fees and settlements when your business is held responsible. By acquiring General Liability Insurance, you can effectively manage potential risks and focus on growing your business without the constant worry of unforeseen accidents or lawsuits.

Additionally, while General Liability Insurance is essential, it’s important to recognize that it may not cover all types of risks your business may face. For instance, it won’t protect against employee injuries, which is where Workers’ Compensation Insurance comes into play. Moreover, in the age of digital connectivity, Cyber Liability Insurance is becoming increasingly crucial to safeguard your business against potential cybercrimes and data breaches. By understanding the different types of insurance available and how they complement one another, you can tailor your coverage to suit your business’s specific needs.

Stay tuned as we delve deeper into the intricate details of General Liability Insurance, exploring its coverage and the significance of other types of insurance in managing your business risks effectively. Whether you’re a small start-up or an established corporation, this comprehensive guide aims to equip you with the knowledge needed to make informed decisions about protecting your business against liability claims. Keep reading to discover the ins and outs of General Liability Insurance and why it’s a fundamental aspect of any robust risk management strategy.

Understanding General Liability Insurance

General Liability Insurance is a crucial type of Commercial Insurance that provides coverage for businesses in the event of accidents, injuries, or property damage that may occur on their premises or as a result of their operations. This type of insurance safeguards businesses from potential legal and financial consequences that may arise from these incidents.

General Liability Insurance covers a wide range of risks and liabilities that businesses may face. It typically includes coverage for bodily injury, such as if a customer slips and falls in your store, as well as property damage caused by your products or operations. Additionally, it may cover personal and advertising injury, which can include claims of defamation or copyright infringement that may arise from your business activities.

It is important to note that General Liability Insurance does not cover all types of risks that a business may encounter. For example, it does not provide coverage for injuries or illnesses to your employees, for which you would need to explore Workers’ Compensation Insurance. Similarly, if your business handles sensitive customer data, you may need to consider Cyber Liability Insurance to protect against data breaches and cyber-attacks.

By obtaining General Liability Insurance, businesses can mitigate potential risks and ensure that they are well-protected. It provides a safety net that can help cover legal fees, medical expenses, and damages that may result from covered incidents. It is essential for business owners to thoroughly understand the specific coverage provided by their policy and ensure that it aligns with the nature of their operations and potential risks they may face.

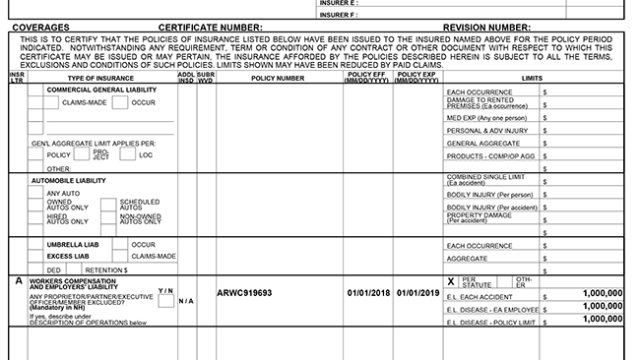

Exploring Workers’ Compensation Insurance

Workers’ Compensation Insurance is a crucial aspect of protecting your business and ensuring the well-being of your employees. This specific type of insurance provides coverage for medical expenses and lost wages in the event that an employee suffers an injury or illness while on the job.

Having Workers’ Compensation Insurance helps mitigate the financial risks associated with workplace accidents, as it provides compensation for employees’ medical treatments, rehabilitation costs, and any necessary accommodations or disability benefits. By safeguarding your business against potential liabilities arising from work-related injuries, you can foster a safer and more secure environment for your employees to thrive in.

Professional Liability South Carolina

Not only does Workers’ Compensation Insurance offer protection for your employees, but it also helps shield your business from costly litigation. In the unfortunate event of an employee filing a lawsuit due to a work-related injury, this insurance takes care of legal expenses and settlements; thus, minimizing the impact on your business’s finances and reputation.

Investing in Workers’ Compensation Insurance demonstrates your commitment to the well-being of your workforce, and compliance with legal requirements in many jurisdictions. By providing financial support for your employees in times of need, you can build strong and trusting relationships that contribute to the overall success of your business.

Navigating Cyber Liability Insurance

In the digital age, protecting your business from cyber threats is more important than ever. Cyber liability insurance is designed to provide coverage for the financial risks associated with data breaches, cyberattacks, and other online security incidents. Understanding the ins and outs of this type of insurance can help you mitigate potential damages and safeguard your business.

One key aspect of cyber liability insurance is its coverage for data breaches. In the event that sensitive customer information is exposed or stolen, this insurance can help cover the costs of investigating the breach, notifying affected individuals, and providing credit monitoring services. It can also assist with any potential legal liabilities that may arise as a result of the breach. Having this coverage can provide peace of mind and ensure that your business is prepared to handle such incidents.

Another important consideration is coverage for cyber extortion. Unfortunately, ransomware attacks and other forms of cyber extortion have become increasingly common. Cyber liability insurance can help protect your business by covering the costs associated with responding to these extortion attempts. This may include expenses related to negotiating with the perpetrators, hiring cybersecurity experts to investigate the incident, and even paying the demanded ransom in certain cases. By having this coverage, you can minimize the financial impact of such attacks.

Moreover, cyber liability insurance can also provide coverage for third-party liabilities. If your business is held responsible for a data breach or other cyber incident that affects individuals or other organizations, this insurance can help cover the legal costs, settlements, or judgments that may arise. It can be instrumental in protecting your business from potential lawsuits and reputational damage that may result from a cyber incident.

By understanding and investing in cyber liability insurance, you can proactively protect your business from the financial consequences of cyber threats. This coverage can provide the necessary support to navigate the complex landscape of data breaches, cyber extortion, and third-party liabilities, allowing you to focus on what you do best: running and growing your business.