Starting and running a small business is an exciting endeavor, but it’s crucial to be aware of the risks that come along with it. Accidents, natural disasters, or even unexpected legal issues can have detrimental effects on your business. That’s where insurance comes in – a vital tool in safeguarding your small business against a wide range of potential threats.

One essential form of insurance to consider is small business insurance. This specialized coverage is specifically designed to protect the unique needs of small businesses, offering financial support in the face of unexpected events. Whether you’re running a brick-and-mortar shop, operating a service-based business, or even managing an online store, having the right insurance coverage can provide you with peace of mind, knowing that your business is protected.

To start, small business insurance typically covers property damage, liability claims, and business interruption. Property damage coverage helps to replace or repair equipment, inventory, or physical spaces damaged by unforeseen events like fires, theft, or vandalism. Liability claims coverage, on the other hand, offers protection in cases where your business is held responsible for causing injury or property damage to others. Finally, business interruption insurance can provide financial assistance, compensating for lost income and ongoing expenses, should your business operations be interrupted due to unforeseen circumstances, such as natural disasters or mandatory closures.

Now that we’ve touched on the basics of small business insurance, it’s just as important to explore other specific insurance options to consider, like car insurance. If your business involves using vehicles for deliveries, transportation, or any other purpose, having appropriate car insurance is imperative. This coverage can protect your business financially in the event of accidents, property damage, or bodily injuries caused by your business vehicles.

As we delve deeper into the world of small business insurance, we’ll explore various types of coverage, their benefits, and what factors to consider when choosing the right insurance policy for your business. So, let’s embark on this comprehensive guide to help you navigate the insurance landscape and ensure your small business remains protected, resilient, and ready to thrive.

Understanding Business Insurance

Small business insurance is a crucial aspect of protecting your company’s assets and minimizing financial risks. Whether you own a small retail store, run a restaurant, or operate a service-based business, having the right insurance coverage can make a significant difference in the event of unexpected circumstances. In this section, we will delve into the basics of business insurance, including why it is essential and the different types of coverage available.

Starting a small business comes with inherent risks, and while no one wants to think about worst-case scenarios, having insurance provides peace of mind. Business insurance is designed to protect your company from financial losses due to property damage, liability claims, and other unforeseen incidents. By having adequate coverage, you can ensure that your business can recover from potential setbacks and continue to thrive.

One essential type of insurance for small businesses is liability insurance. This coverage protects your company against claims of property damage or personal injury. For instance, if a customer slips and falls in your store, liability insurance can help cover the medical expenses and potential legal fees associated with the incident. Another vital aspect is property insurance, which safeguards your physical assets, such as your building, equipment, and inventory, against damages caused by fire, theft, or natural disasters.

In addition to liability and property insurance, another key consideration is car insurance if your business relies on vehicles for its operations. Commercial auto insurance covers damages and liabilities resulting from accidents involving company-owned vehicles. Having this coverage can provide financial protection whether you have one company car or an entire fleet.

Understanding the importance of business insurance is vital for small business owners. By investing in the right coverage for your specific needs, you can protect your assets, safeguard your business from unforeseen events, and ensure its long-term success. In the next section, we will explore different types of business insurance in more detail.

Note: The title of this section has been adjusted to adhere to the given instructions.

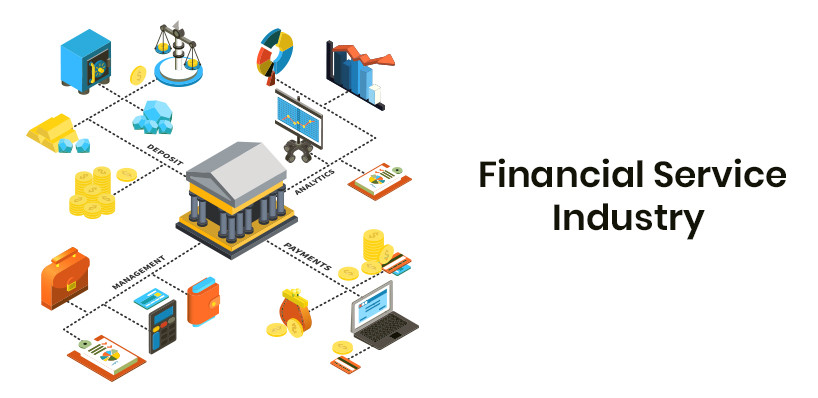

Types of Insurance for Small Businesses

Small businesses face a variety of risks on a daily basis, whether it’s damage caused by natural disasters or legal issues arising from accidents. This is why having the right insurance coverage is crucial for protecting your small business and ensuring its long-term success.

-

Insurance for Property Damage: Small Business Insurance provides coverage for property damage caused by unforeseen events such as fires, floods, or vandalism. This includes protection for your physical assets, including buildings, equipment, and inventory. By having this type of insurance, you can have peace of mind knowing that your business will be financially safeguarded in the event of any unexpected damages.

-

Liability Insurance: Accidents happen, and your small business can be held liable for any injury or property damage caused by your products, services, or employees. Liability insurance provides coverage for legal costs and compensation claims, protecting your business from significant financial loss. It is an essential form of insurance for small businesses, as it offers protection against unforeseen legal expenses and potential lawsuits.

-

Commercial Auto Insurance: If your small business relies on vehicles for essential operations, such as making deliveries or transporting goods, having commercial auto insurance is vital. This type of insurance covers accidents, theft, and damage to your vehicles, as well as any liability that may arise from using them. It ensures that you are financially protected in case of accidents or damage involving your business vehicles.

By understanding and obtaining the right types of insurance coverage, you can effectively manage risks and protect your small business from a wide range of potential threats. These include property damage, liability issues, and accidents involving your business vehicles. Investing in comprehensive insurance allows you to focus on growing your business with confidence, knowing that you have taken the necessary steps to safeguard its future.

Choosing the Right Insurance

When it comes to protecting your small business, choosing the right insurance is crucial. You need coverage that specifically caters to the needs of your business and ensures that you are adequately protected. There are various types of insurance policies available, and understanding them can help you make an informed decision.

-

General Liability Insurance: This type of insurance is essential for any small business. It provides coverage for third-party claims of bodily injury, property damage, and personal injury. General liability insurance safeguards your business from financial losses in case of accidents, lawsuits, or claims filed against you.

-

Property Insurance: Whether you own or lease your business premises, having property insurance is vital. It offers protection against damage or loss of your business property, including buildings, equipment, inventory, and furniture. Property insurance can aid in replacing or repairing damaged assets due to events like fire, theft, vandalism, or natural disasters.

-

Professional Liability Insurance: Also known as errors and omissions insurance, professional liability insurance is crucial for businesses that provide professional services or advice. It helps cover legal expenses and damages in case a client alleges negligence, errors, or mistakes that have caused them financial harm.

By carefully considering these insurance policies, you can make informed choices that align with the specific needs of your small business. Remember that every business is unique, so it’s crucial to assess your risks, consult with insurance professionals, and select the right coverage to protect your business, your employees, and your customers.