Welcome to our article on Captive Insurance: Unlocking Financial Freedom. In this insightful piece, we will delve into the world of captive insurance and how it can potentially offer you unprecedented financial security and control.

Captive insurance, a concept commonly associated with the 831(b) tax code established by the IRS, allows businesses to form their own insurance companies to cover their own risks. This self-insurance approach empowers companies to tailor coverage to their specific needs, providing a level of customization and flexibility that traditional insurance policies may lack.

By forming a captive insurance company, businesses can take advantage of the tax benefits provided by the 831(b) tax code. This code enables qualifying captives, also known as microcaptives, to benefit from tax advantages such as premium deductions, tax deferral, and tax-exempt investment income. These financial incentives can significantly enhance a company’s ability to manage risk and optimize their overall financial strategy.

In the following sections, we will explore the intricacies and potential advantages of captive insurance in more detail, demonstrating how this progressive approach to risk management can unlock new avenues of financial freedom for businesses. So, let’s embark on this journey of discovering a captivating world of financial protection through captive insurance.

Understanding Captive Insurance

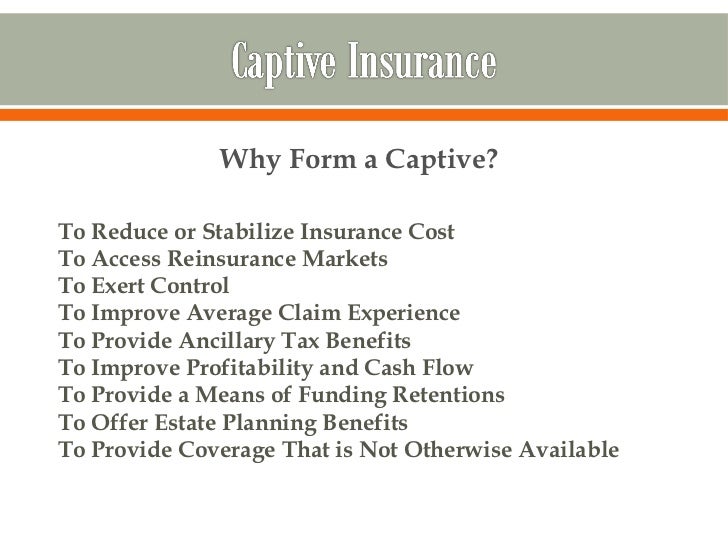

Captive insurance is a unique form of self-insurance that allows businesses to take control of their own risk management. Unlike traditional insurance policies, which are purchased from commercial insurers, captive insurance involves setting up an insurance company within the business itself. This captive insurance company then provides coverage for the risks faced by the parent company.

One key benefit of captive insurance is the potential for cost savings. By insuring through a captive, businesses can avoid the premiums charged by commercial insurers, which often include profit margins and overhead costs. Instead, the premiums paid are used to fund the captive insurance company directly, allowing for greater control over the financial aspects of insurance.

The Internal Revenue Service (IRS) has a specific tax code, known as 831(b), which governs the taxation of captive insurance companies. This code allows captives with premium income under a certain threshold to be taxed on their investment income only, rather than on their underwriting profits. This tax advantage has made captive insurance an attractive option for many businesses, particularly smaller ones.

Overall, captive insurance provides businesses with the opportunity to manage their risks in a more tailored and cost-effective manner. By creating their own insurance entity, companies can gain greater control over their insurance programs, potentially reducing costs and increasing financial freedom.

The Benefits of Utilizing 831b Captive Insurance

-

Tax Advantages: Captive insurance, specifically under the IRS 831(b) tax code, offers significant tax advantages. By forming a captive insurance company, businesses can potentially reduce their taxable income by deducting the premiums paid to their captive as ordinary and necessary business expenses. This allows for the accumulation of wealth within the captive, as the premiums can be invested and grow tax-free until they are needed to cover potential losses or claims.

-

Risk Management and Cost Control: Captive insurance enables businesses to have more control over their risk management strategies and costs. By forming their own captive, businesses can tailor insurance coverage specific to their unique needs and risks. This customization allows for more efficient risk management and typically results in more comprehensive coverage than what is available in the traditional insurance market. Captives can also provide stable pricing and reduce reliance on fluctuating commercial insurance markets, providing long-term cost stability.

-

Asset Protection: Another benefit of captive insurance is the potential for asset protection. By establishing a separate legal entity for insurance purposes, businesses can shield their assets from potential liabilities. If properly structured and managed, the assets held within the captive can be protected from creditors, lawsuits, and other financial risks. This additional layer of protection can be crucial for businesses in high-risk industries or facing potential litigation.

By understanding and utilizing captive insurance, businesses can unlock financial freedom by leveraging tax advantages, gaining control over their risk management strategies, and protecting their assets. The flexibility and customization offered by captives make them a valuable tool for businesses seeking to optimize their insurance coverage and secure their financial future.

Navigating the IRS 831b Tax Code

When it comes to captive insurance, understanding the IRS 831b tax code is essential. This tax code provides a unique opportunity for businesses to explore the benefits of forming a captive insurance company.

First and foremost, the IRS 831b tax code allows qualifying small insurance companies, known as microcaptives, to be taxed on their investment income at a significantly lower rate. Under this code, eligible captives can enjoy certain tax advantages that can contribute to their financial freedom.

It is important to note that to qualify for the benefits outlined in the IRS 831b tax code, certain criteria must be met. Companies must operate as legitimate insurance companies, covering risks of their affiliated entities. They should also have a premium threshold that falls within the permissible range set by the code.

Understanding the regulations and requirements laid out in the IRS 831b tax code is crucial for those considering venturing into captive insurance. By navigating this code effectively, businesses can unlock the financial freedom that captive insurance can offer, maximizing their potential for success.