Securing Your Business: Unraveling the Importance of Commercial Property Insurance

Starting a business comes with its fair share of risks, and protecting your assets should be a top priority. This is where commercial property insurance plays a crucial role. Whether you own a small retail store, a bustling office space, or a large manufacturing facility, having the right insurance coverage can provide you with the peace of mind you need to focus on growing your business.

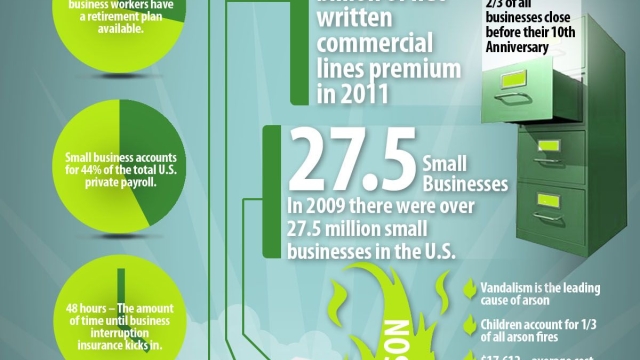

Business insurance, particularly commercial property insurance, safeguards your physical assets from a range of perils, including natural disasters, theft, vandalism, and more. It serves as a safety net, helping you recover financially in the event of unforeseen damages or losses. With commercial property insurance, you can rest assured that your brick-and-mortar establishment, equipment, inventory, and valuable assets are adequately protected.

Understanding Commercial Property Insurance

Commercial property insurance is a crucial aspect of protecting your business and its assets. This type of insurance provides coverage for physical property, such as buildings, equipment, inventory, and furniture, in the event of damage or loss due to covered perils. Having commercial property insurance ensures that your business can recover financially and continue operations in the face of unexpected circumstances.

Businesses face a variety of risks, ranging from natural disasters like fires, storms, or floods, to unforeseen events such as theft, vandalism, or accidents. Commercial property insurance helps mitigate these risks by providing financial compensation for the repair or replacement of damaged or stolen property. It also extends coverage to include potential business interruptions due to covered perils, ensuring that your business can continue operating even if your physical property is affected.

When selecting a commercial property insurance policy, it is essential to carefully analyze and evaluate your business’s specific needs and risks. Factors such as the type of property, its location, and the nature of your business all play a role in determining the coverage required. Working with an experienced insurance agent can help you navigate the various options and select a policy that provides adequate protection for your business assets.

Investing in commercial property insurance not only safeguards your physical assets but also offers peace of mind. Knowing that your business is protected financially in the face of unexpected events allows you to focus on driving growth and success. Remember, protecting your business with comprehensive insurance coverage is a proactive step towards securing, sustaining, and nurturing your business’s future.

Benefits of Commercial Property Insurance

Commercial property insurance provides essential coverage for businesses, safeguarding their physical assets and helping to mitigate financial risks. By investing in this type of insurance, businesses can enjoy several key benefits.

Firstly, commercial property insurance offers protection against property damage or loss caused by unforeseen events such as fires, natural disasters, vandalism, or theft. This means that if your business premises, equipment, or inventory suffer damage or are lost, you can rely on your insurance policy to help cover the costs of repair or replacement.

In addition to physical damage, commercial property insurance can also provide coverage for business interruption. This means that if your business is forced to temporarily close due to a covered event, such as a fire or flood, the insurance policy can compensate you for the income you would have earned during the closure period. This can help businesses stay afloat and overcome the financial setbacks caused by unexpected disruptions.

Furthermore, commercial property insurance often includes liability coverage. This protects businesses from legal claims and financial liability if someone is injured on their premises or if their actions cause harm to someone else’s property. Having liability coverage can provide peace of mind and help businesses navigate potential lawsuits or claims, which can otherwise be financially devastating.

In conclusion, commercial property insurance offers a range of important benefits for businesses. It provides protection against property damage or loss, helps cover the costs of business interruption, and offers liability coverage. By investing in this type of insurance, businesses can safeguard their assets and financial stability, allowing them to focus on their core operations with confidence.

Choosing the Right Commercial Property Insurance

When it comes to protecting your business and its assets, choosing the right commercial property insurance is crucial. With the numerous options available in the insurance market, finding the policy that best suits your business needs can be a daunting task. However, by considering a few key factors, you can make an informed decision.

Firstly, it’s important to assess the value of your commercial property accurately. Understanding the worth of your property will help you determine the appropriate coverage amount. Factors such as location, construction materials, and the size of the property can impact its value, so be sure to include all relevant details to ensure adequate coverage.

Secondly, consider the specific risks that your business faces. Different industries may have unique hazards that require specialized insurance coverage. For example, if you own a restaurant, you may need coverage for potential damage caused by a fire or water leakage. On the other hand, if you operate a manufacturing facility, protecting against equipment breakdowns may be a priority. Identifying your business’s vulnerabilities will enable you to select a policy that provides comprehensive protection.

Lastly, it’s essential to review the terms and conditions of the insurance policies you are considering. Pay close attention to coverage limits, deductibles, and exclusions. Take into account your budget and assess whether the premium costs align with the coverage offered. Additionally, consider the reputation and reliability of the insurance provider. Look for a company that has a track record of responsive claims handling and excellent customer service.

Condo Insurance South Carolina

By carefully evaluating the value of your commercial property, understanding your business’s unique risks, and thoroughly reviewing policy details, you’ll be able to choose the commercial property insurance that offers optimal protection for your business. Remember, having the right insurance coverage ensures the security and continuity of your business operations.